If you're not driven or do not push yourself to prosper, your income will reflect that. That being said, insurance coverage representatives who strive, are continuously remaining up to date Look at more info with the marketplace, and are making an effort to acquire devoted customers will be incredibly successful in this market. When you become an independent insurance coverage representative, you're in business on your own, however that doesn't mean you're in company on your own. FMOs like Ritter Insurance coverage Marketing can supply you with the resources you need to be effective, like dedicated employee and your very own site to estimate and register customers in plans.

The bulk of this job involves dealing with clients, so if you don't like dealing with people, this might not be the profession course for you. In order to gain customers, you will more than likely need to make cold calls. If this stresses you out, it's something to think about before pursuing a profession in the insurance coverage industry. Does knocking on somebody's front door provide you anxiety? Possibly rethink ending up being an agent. If you decide to start in insurance sales, we extremely suggest that you're a people individual. You will likewise constantly need to take your customers' requests into factor to consider, as the basis of this job is discovering them a strategy that fits their requirements.

As an independent insurance coverage representative, you are generally your own boss. You have the liberty to decide how you want to run your company. What is ppo insurance. On the other side of that, however, you will not be provided paid time off or ill days. The very same chooses holidays. You most likely will not be consulting with any customers on Thanksgiving or the 4th of July, but you won't get paid for those days either. We do not believe this is an offer breaker by any ways, however it's something to be knowledgeable about as you begin your journey. Any organization is going to have pros and cons.

Start a discussion with Ritter today, and we'll assist address your concerns with tips, assistance, and assistance! Currently comprised your mind? Register with Ritter for totally free and begin your journey to owning your own insurance coverage organization.

Not known Facts About What Is A Premium In Insurance

Back in 2011, when the world was really different than today, selling life insurance coverage from home looked like a crazy concept. How do we understand? Due to the fact that everybody that we talked to about what we were doing and our idea to deal with clients throughout the country told us it would not work - How much is mortgage insurance. Those people would never ever trust paying big premiums on a policy that was offered to them from someone they could not see or smell. However in truth, this site began as an effort to do just thatto bring in clients that would have an interest in buying life insurance. And that a huge majority of the organization conducted would be done so in a virtual environment.

That is the million-dollar question, isn't it? The majority of people who sell life insurance from home definitely make it a profession. To be honest, offering life insurance part-time appears like an uphill struggle as it is not the type of work that fits nicely into compartmentalized time blocks. Obviously, that will depend upon what type of life insurance selling you choose to focus on for your career. Speaking from experience, the time and energy it requires to educate, guide, and direct the sale of blended (term riders with paid-up additions) entire life insurance policies or indexed universal life insurance would be difficult to manage on a part-time basis.

As you may or might not understand, these kinds of life insurance have illustrations that need to be signed and acknowledged when using. A lot of people, desire to comprehend what is going on prior to signing it, which is sensible. Remember, with money value life insurance policies lots of times people are investing lots of $20k+ every year in premium and they plan to do it for several years. That's a considerable commitment and they need to be sure that they comprehend all the advantages and disadvantages of the specific whole life policy you are advising to them. https://expressdigest.com/timeshare-fraudster-62-is-told-to-pay-back-20000/ The same can be stated for index universal life insurancesome even claim it requires more description.

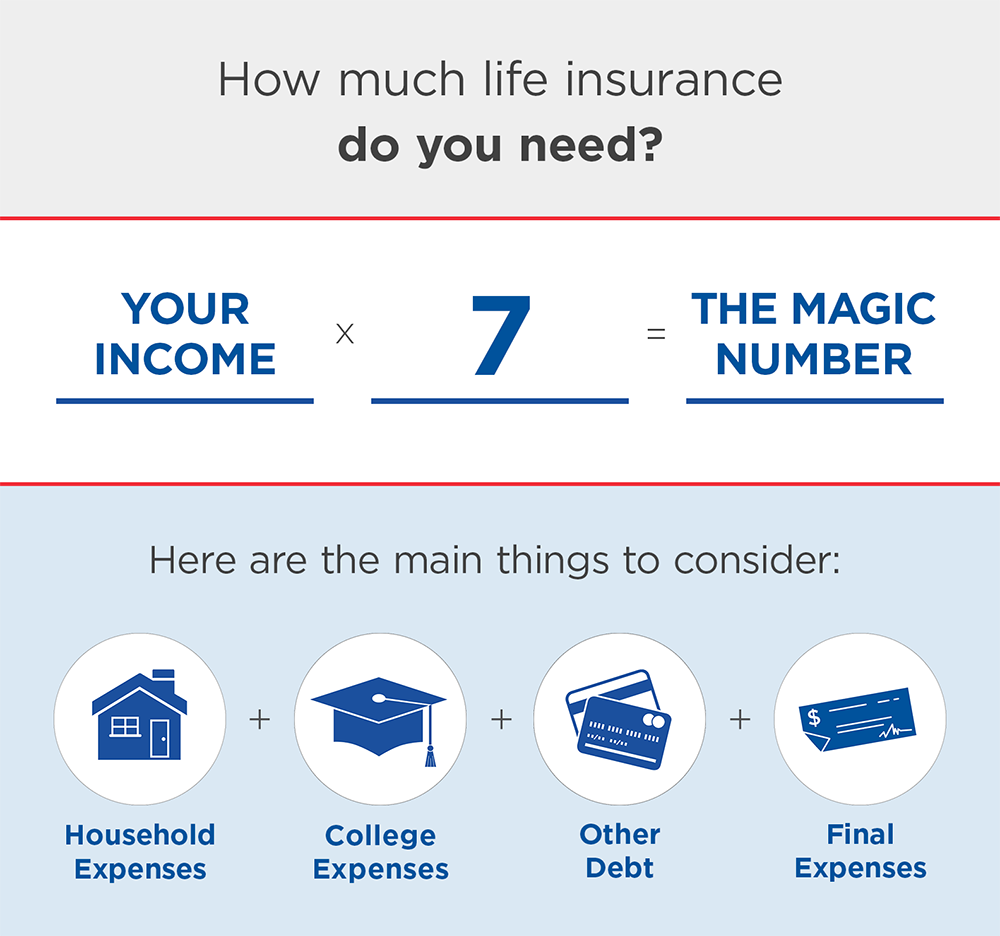

Yes, you can certainly earn money selling life insurance coverage from home. It's a reasonably basic company depending on what kind of life insurance coverage you are selling and the needs of your clients. Something that has actually not yet been gone over in this post is that many people who offer life insurance coverage from home are concentrated on selling term life insurance. Selling term insurance from house definitely is less complex than welling mixed entire life insurance and indexed universal life insurance coverage. Mainly due to the fact that term insurance coverage is an extremely basic item to comprehend. You pay an affordable premium to whatever business will give you the finest rate for the death advantage you 'd like to have provided your health profile.

The Basic Principles Of How Much Is Car Insurance

The big difficulty with offering only term insurance coverage is that for most of agents, there is no renewal commission. That means you will just be paid commission on the first year's premium. After that, you will receive nothing in payment. That is not necessarily a bad thing, just the reality here with offering mostly term insurance. You will require to process a much higher volume of business each year and with much higher regularity. To break that down into its most essential activityyou 'd much better have a way to fresh leads in the door every day or at the extremely least a couple times every week.

Your level of success will be figured out largely by your dedication to whatever design you choosethe kind of life insurance coverage you concentrate on will determine how you construct your business to be most effective and how much cash you will make. There is no set amount that a life insurance coverage representative makes on each policy. Your first-year commission is generally a percentage of the annual premium for the policy. The percentages can vary from business to company and from agent to agent. As a general guideline, you will start making around 80% commission as a brand-new representative. Someone is going to compose to tell us how incorrect this number is which you can make a lot more or much less.

That indicates if you offer a policy that has a $1,000 annual premium, you will be paid $800 in commission on the policy. If the client pays monthly, you will be paid your commission every month. There is also something called a commission advance that some business will provide but I would caution versus it if at all possible. You might easily wind up in a situation where a client stops paying their premium in the first year and you (agent) owe the life insurance coverage business for the cash that was advanced to you. If you are working as an independent representative and being paid as a 1099 professional, as the majority of us are, the sky is the limit.